Online Learning Services - Risk Management BNCTL

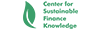

The banking environment is very fast changing, both in terms of politics, economy, social and technology. Therefore, banks need to develop strategies so they can surf the tide of change. Failure to make adjustments will have a significant impact on the bank. The risks faced are increasingly large and increasingly diverse. Therefore, banks always implement risk management - in accordance with the bank's vision and mission and regulations. One important aspect in the application of risk management is the competence of human resources at each level in order to be able to manage risk according to its level, in inherent risk and the quality of risk management implementation.

This program is intended to equip BNCTL bank employees how to identify up to risk mitigation so that bank profitability increases at the operational, first and middle level. Understanding of risk management in the first layer (first line of defense of risk management) becomes very important to create long-term profitability. In addition, the framework and consistency in the implementation of all policies and procedures as well as intensive compliance will create a culture of risk and good compliance. Generally, the main risk faced by this level is operational risk. Failure to manage can create other risks such as credit risk, liquidity, compliance risk, strategic risks and so on. The application of operational risk management becomes important to understand to create good bank health.